eNews – September 26, 2025

Annual Conference agendas and Annual Business Meeting documents are now available...and more!

Friday, September 26, 2025/Categories: eNews

This edition of eNews is sponsored by Mattern & Craig providing comprehensive civil and sanitary engineering services to public, corporate and governmental agencies throughout Virginia, Tennessee, North Carolina and South Carolina. Learn more >

In this issue:

VML Annual Conference

Finance

FOIA

Transportation

VML Annual Conference

Mayors Institute and Annual Conference agendas now available

Both agendas are now posted to VML’s website here >.

Some items of note:

- The Mayors Institute runs Oct. 11-12 with the first day devoted to a guided session from award winning mentor and coach Gary Campbell presenting his “Inspiring a Culture of Excellence” workshop. The Mayors Institute will wrap up at 11:00 a.m. on Oct. 12.

- The Annual Conference registration desk opens at 11:00 a.m. on Oct. 12 and the Opening Session kicks off at 2:00 p.m. to be followed by two groups of “Local Government Learning Labs” featuring quick presentations on a variety of important topics.

- The Awards Banquet will take place the evening of Oct. 12 (congratulations to all our Innovation Award winners!). The winner of the President’s Award for Innovation will be announced during the banquet.

- Section Meetings will take place during the morning of Oct. 13 and will be followed by concurrent breakout sessions.

- There will be three concurrent mobile workshops the afternoon of Oct. 13. There is one bus per workshop and seating is first come, first served. For those not going to the mobile workshops there will be programming at the conference.

- The Annual Business meeting will begin at 3:30 p.m. on Oct. 13.

- The evening of Oct. 13 will kick off with a VML hosted Bluegrass Reception featuring the live musical stylings of The Hot Seats and concluding with a City of Roanoke hosted event at the Taubman Museum of Art (a short walk from the Hotel Roanoke).

- The Closing Session the morning of Oct. 14 will feature two very important discussions. First, a panel discussion on the future of Virginia’s economy considering recent actions by the federal government and then a keynote address from David Poole (founder of the Virginia Public Access Project) on the state’s political forecast and Virginia finally welcoming its first female governor.

See you in Roanoke!

VML Contact: Rob Bullington, rbullington@vml.org

Guest/Spouse ticketed Lunch & Learn Oct. 13 to feature a fused glass nightlight workshop

Tickets are limited for this special lunch event that will take place at the Hotel Roanoke from noon-2:00pm on Oct. 13. These can be purchased a-la-carte for $60 which includes lunch and a guided fused glass workshop with Pam Golden, proprietor of the Glazed Bisque-It in Roanoke. Pam will help participants complete a fused glass night light project which will then be kiln fired that evening and available for pickup the following morning prior to the close of the conference.

Whether your fused glass night light creation finds a home in your home, under a Christmas tree with a tag for your favorite relative, or at the office’s White Elephant holiday party, it’s sure to be a hit!

Tickets can be purchased using the Conference Registration process on VML’s site here >.

Contact Manuel Timbreza if you have any questions or need assistance getting registered.

VML Contact: Manuel Timbreza, mtimbreza@vml.org

Proposed 2026 legislative program and policy statements posted

The 2026 proposed policy statements and legislative program are posted on the VML website for your review.

All these items will be taken up during the VML Annual Business meeting on Monday, Oct. 13, in Roanoke. The policy committee chairs and legislative committee chair will present the proposed items, and the membership will discuss and vote on adoption of each statement and the legislative program.

Copies of the proposed policy statements and legislative program will be available at the conference.

VML Contact: Janet Areson, jareson@vml.org

Please review proposed changes to VML Constitution prior to Annual Business Meeting on Oct. 13

The changes to the VML Constitution outlined below will be voted on by members at the Annual Business Meeting which will be held during the 2025 Annual Conference at the Hotel Roanoke.

VML Contact: Michelle Gowdy, mgowdy@vml.org

Finance

Unfunded state mandates continue to exert pressure on local revenues

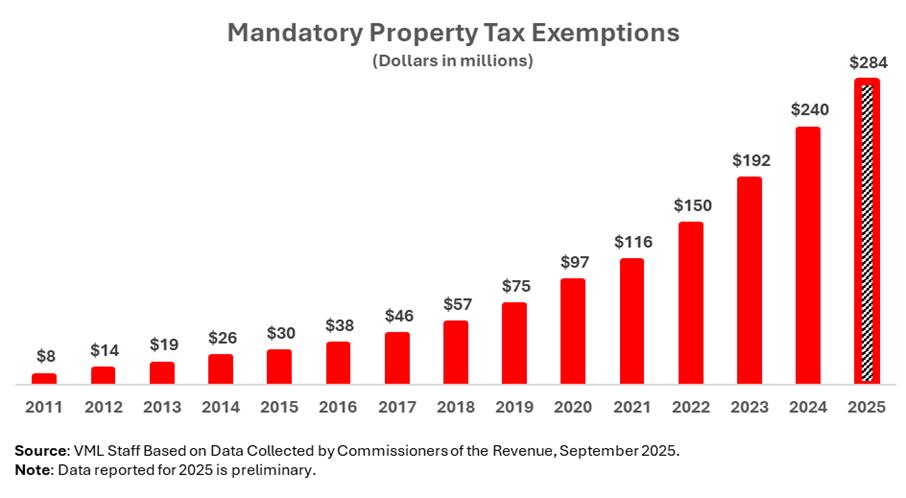

State-mandated property tax exemptions for disabled veterans or their surviving spouses or the surviving spouses of service members who died in the Line of Duty, continue to strain local budgets. Based on preliminary data reported to Virginia’s Commissioners of the Revenue, it is estimated that localities will forego at least $284 million in local property tax revenues in 2025, an increase of 18% compared to the prior year. The total will likely exceed $300 million when several large localities report the most recent data to their commissioners.

Interestingly, the rising cost of these unfunded state mandates is affecting revenue collections across the Commonwealth. For example,

- In Chesterfield County, the cost of mandatory property tax exemptions nearly tripled from $5.7 million in 2020 to $16.3 million in 2025.

- In Virginia Beach, budget staff reported that “program participation in the Veterans Real Estate Tax Relief Program has risen by 7,046 individuals since 2013 at a total estimated cost of $36.2 million in FY 2025-26 or nearly 4.1 cents of the real estate tax.”

- In Fauquier County, these mandatory exemptions cost the county $3.0 million in 2025 or more than 2% of their local property tax revenues. The cost of providing these exemptions grew by 31% in 2025.

- In Bristol, property tax exemptions grew by 53% from 2024 to 2025.

Admittedly, the reported revenue losses in Fauquier and Bristol are much smaller than Virginia Beach and Chesterfield but provides further evidence that mandatory property tax exemptions are affecting communities across the Commonwealth and not just northern Virginia and Hampton Roads.

As a reminder, legislation that was enacted by the General Assembly and approved by the voters requires several populations to be exempted from local property taxes. According to the Department of Taxation those exempted from local property taxes include:

- Disabled Veterans and Surviving Spouses – Authority granted by Article X, section 6-A of the Constitution of Virginia exempts from real property taxation (i) the qualifying dwelling or qualifying portion thereof, and (ii) up to one acre of land up on which such dwelling is situated, of a disabled veteran or the widow or widower of such a veteran. The exemption applies to tax years beginning on or after January 1, 2011, and requires that the veteran has been determined by the United States Department of Veterans Affairs or its successor agency pursuant to federal law to have a 100 percent service-connected, permanent, and total disability. The surviving spouse of a veteran is eligible for the exemption so long as the death of the veteran occurred on or after January 1, 2011, the surviving spouse does not remarry, and the surviving spouse continues to occupy the real property as their principal residence.

- Surviving Spouses of Service Members who died in the Line of Duty – Article X, Section 6-A of the Virginia Constitution and the Virginia Code exempt, for years beginning on or after January 1, 2015, from taxation the real property of the surviving spouse (i) of any member of the armed forces of the United States who died in the line of duty as determined by the U.S. Department of Defense and (ii) who occupies the real property as his principal place of residence. [NOTE: In November 2024, this exemption was expanded from members of the armed forces of the US who were killed in action to died in the line of duty. The cost of this change is unknown.]

At a time when actions by the federal government are shifting costs and adding unfunded mandates to state and local governments, another layer of fiscal uncertainty on the table is the last thing local governments need right now. VML will continue to convey that message to state budget officials and remind them that mandatory property tax exemptions are forcing local governments to reconsider funding for other needs in their communities such as optional tax relief for the elderly and disabled, resources for K-12 education, and taxation levels in their communities.

VML Contact: Joe Flores, jflores@vml.org

FOIA

Virginia Freedom of Information Advisory Council and its subcommittees meet

The Virginia Freedom of Information Advisory Council (FOIA Council) held a full day of meetings on Monday, Sept. 22 with their records subcommittee, meetings subcommittee, and the full council all gathering at the General Assembly building.

The meetings subcommittee took up the issue of stakeholder group meetings at the state level where the groups did not include members of a state public body's governing board or any agency heads but consisted solely of interested parties. There is a perception that agencies treat these groups differently, with some treating them as public bodies that must adhere to FOIA's meetings rules and others saying these groups are not public bodies. It was requested that the issue be studied with an eye toward addressing these meetings in the definitions section of FOIA. There was a lot of discussion about the inconsistency, but no consensus in the end.

The records subcommittee took up HB1590 (Kent) which excludes from the mandatory disclosure requirements of FOIA any personal information in a public record regarding the participation of a minor in a program run by a state public body, such as an internship, externship, or apprenticeship, except as otherwise prescribed by law. The language from the original bill was improved and the full committee and subcommittee approved the latest version.

The records subcommittee then received a report on the definition of “personal information” and was given some research from other states. There was no consensus on what the definition should be and there was a request for further research.

Lastly, the records subcommittee took up the issue of vexatious requests and harassment by requesters. There was a lot of discussion and a review of what some other states do; but there was no consensus.

The Full Committee met last and agreed with the actions taken by the subcommittees. Then they took up Ebbin’s HB876 and have asked that the bill be redrafted based upon comments in the meeting. Despite a lot of issues still being discussed; the Chair indicated that the Council would not meet again until next spring.

VML Contact: Michelle Gowdy, mgowdy@vml.org

Transportation

Transit funding changes expected by the end of the year; Localities should prepare to provide input

Making Efficient and Reliable Investments in Transit Program (MERIT) is undergoing a triennial review as required by the Code of Virginia. The Department of Rail and Public Transportation (DRPT) has proposed updates to the current MERIT Capital and Operational funding formulas. These proposed changes are expected to be approved by the Commonwealth Transportation Board in December and to be in effect Fiscal Year 2028.

The review of MERIT examines the effectiveness and efficiency of service delivery factors as well as the relative weight of these metrics as established by the Commonwealth Transportation Board. The new factors are intended to be outcome focused, prioritize allocating funds based on performance, provide “formula simplification”, and “year-over-year predictability” of funding allocations.

Localities with transit companies and systems big and small should be aware that this process will undergo a 45-day public comment period starting in October. VML members should discuss these funding changes with the appropriate staff and transit directors to understand how these changes might impact future transit funding in your community. Members are encouraged to be prepared to submit comments on the proposed changes to MERIT when the comment period begins likely in mid-October.

More details about how these proposed changes might impact future transit operational and capital funding can be found in the most recent presentation to the Transit Service Delivery Advisory Committee available here >.

VML will continue to report on this topic as more details become available.

VML Contact: Mitchell Smiley, msmiley@vml.org