eNews – June 27, 2025

State agency heads outline potential impacts of federal budget changes, FOIA subcommittees meet, CTB approves six-year plan...and more!

Friday, June 27, 2025/Categories: eNews

This edition of eNews is sponsored by Airbnb whose hosts offer unique stays, experiences, and services that make it possible for guests to connect with communities in a more authentic way. Learn more >

In this issue:

VML News

Finance

FOIA

Transportation

Natural Resources

Resources

VML News

Make plans to attend the 2025 Mayors Institute & Annual Conference

Make plans to attend the 2025 Mayors Institute & Annual Conference

VML looks forward to welcoming our members to the amazing Hotel Roanoke this October.

The Mayors Institute begins Saturday, October 11 and concludes the morning of Sunday, October 12.

The Annual Conference begins in the afternoon of Sunday, October 12 and concludes mid-morning on Tuesday, October 14.

Event registration and lodging information are available here >.

See you in Roanoke!

VML Contact: Rob Bullington, rbullington@vml.org

VML now accepting 2025 Innovation Awards submissions

VML now accepting 2025 Innovation Awards submissions

The Virginia Municipal League’s Innovation Awards celebrate the programs and individuals that make it possible for our local governments to solve pressing problems, address emerging needs, and adapt to changing circumstances.

Local governments of all sizes are encouraged to compete for coveted Innovation Awards across seven categories. The entries will be judged based on the scope and results of the project in relation to the community’s size, thereby putting all localities on a level playing field.

One of the seven category winners will be selected for the prestigious President’s Award for Innovation. The winner of the President’s Award will be revealed when all the award winners are honored during the Awards Banquet at the VML Annual Conference in Roanoke in October.

Don’t miss this premiere opportunity to spotlight innovative programs that make your town, city or county a great place for people to call home!

Learn more and download the entry form on VML’s website here >.

VML Contact: Manuel Timbreza, mtimbreza@vml.org

Finance

State agency heads paint a grim fiscal picture for the Commonwealth if federal budget changes are adopted

As word about layoffs continues to trickle out of state agencies, the Commissioner of the Department of Social Services (DSS) and the Director for the Department of Medical Assistance Services (DMAS) began to shed light on the cost to Virginia of changes under consideration in the U.S. Senate.

With the caveat that negotiations are still in flux, Commissioner James Williams told members of the House Appropriations (HAC) and Senate Finance & Appropriations (SFAC) Committees that three substantive changes to the SNAP program would impose additional general fund costs on the Commonwealth for food stamp benefits, administrative costs, and expanded work requirements.

For example, the Commonwealth would be on the hook for as much as 25% of the cost of SNAP benefits if proposed changes are enacted; heretofore, the federal government has provided 100% of the cost of providing food stamp benefits to eligible recipients. Estimated annual costs to the Commonwealth range from $88 million to $455 million, depending on the program’s error rate. An overpayment, underpayment, or ineligible payment to a SNAP beneficiary is considered an error.

Based on the most recent 9.9% error rate (which has not fallen below 9.3% since 2017), the Commonwealth can expect to pay $359 million annually from the general fund to provide benefits to low-income Virginians. The effective date for this change is October 1, 2027.

Another change mandates that the state pays 75% of the administrative cost for SNAP instead of the current 50/50 split with the federal government. That modification is expected to cost the Commonwealth $87 million annually. Making matters worse, that change is slated to go into effect on October 1, 2025, only three months from now.

Also on the table is a requirement that more SNAP recipients participate in work-related activities to continue receiving benefits. That provision has an unknown fiscal impact.

|

Potential Annual Cost to DSS of Federal Changes

|

|

Policy Change

|

General Fund Impact

|

|

Require State Share of SNAP Benefits

|

$359 million

|

|

Increase State Administrative Costs

|

$87 million

|

|

Increased Work Participation

|

TBD

|

Following Commissioner Williams, Medicaid Director Cheryl Roberts and Chief Financial Officer Chris Gordon painted a sobering picture of potential changes coming down for the Medicaid program. In addition to more frequent eligibility determinations that will increase workload demands on local employees, the proposed Medicaid changes may come with a significant price tag for Virginia’s Hospitals.

Specifically, Mr. Gordon asserted that the Senate version of the budget reconciliation bill eliminates $2.3 billion in annual supplemental hospital payments to 63 hospitals in the Commonwealth, including critical access hospitals that primarily serve rural communities. That action alone would have a devastating impact on hospitals not only in Virginia but nationwide, which is why hospitals are lobbying furiously against some of these Medicaid proposals in Congress.

It goes without saying that the budget changes being contemplated in D.C. will layer on additional uncertainty as the Commonwealth’s finances and local communities face an unsettled fiscal landscape. As much as VML staff prefer to look away as this sausage is cobbled together, we’ll keep our eyes peeled to gain further clarity on the potential impact on cities, counties, and towns.

VML Contact: Joe Flores, jflores@vml.org

General fund revenues appear strong through May 2025 even as economic outlook remains uncertain

Compared to the forecast that the budget is based upon, general fund revenues are up $488 million or 1.8% through May, according to recent testimony provided by Secretary Stephen Cummings to the General Assembly’s “money committees.”

In separate hearings before the House Appropriations (HAC) and Senate Finance & Appropriations (SFAC) Committees last week, Governor Youngkin’s Secretary of Finance expressed optimism about the Commonwealth’s ability to meet the forecast for the rest of the fiscal year.

Looking more closely at the details, general fund revenues from withholding (i.e., wages and salaries) and sales and use taxes were up 0.2% year-to-date (YTD), compared to the forecast. Since revenues from these two categories – withholding and sales – are often seen as the lifeblood of the Commonwealth’s general fund revenues, anemic growth through May raises questions about the strength of Virginia’s economy as we face the likelihood of fiscal headwinds in FY 2026.

Revenues from nonwithholding taxes, such as dividends and capital gains and self-employment, are up 10.1 percent YTD, accounting for most of the excess revenues through May 2025.

In August, Governor Youngkin and Secretary Cummings will explain in further detail for the members of the HAC and SFAC how the Commonwealth fared overall on the budget through June 30, 2025. Soon thereafter, the Governor and Secretary will commence work on the final budget that they will present in December 2025.

VML Contact: Joe Flores, jflores@vml.org

At-a-glance: Resources that support local government operations

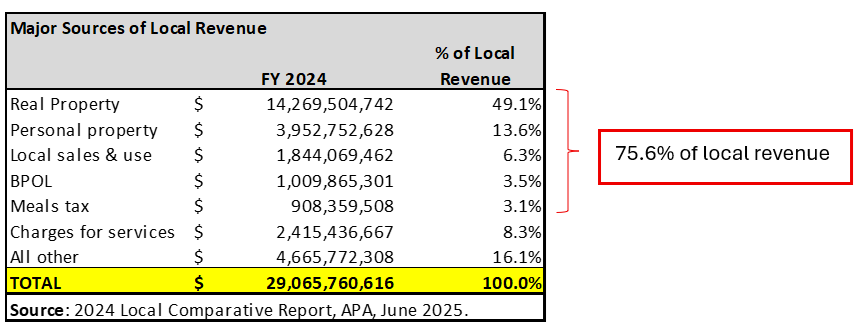

According to the Auditor of Public Accounts (APA), cities, counties, and towns generated $29.1 billion in local revenues in the fiscal year that ended on June 30, 2024. Localities also received $13.4 billion from the Commonwealth and $3.9 billion from the federal government during the same period, oftentimes for specific purposes.

In FY 2024, more than two-thirds of spending at the local level was devoted to K-12 education (53%) and public safety (17%), putting these categories of expenditure at greater risk during uncertain economic times.

Five local taxes account for three-quarters of all revenues generated by cities, counties, and towns (see table below) including 1) Real property taxes; 2) Personal property taxes; 3) Local sales and use taxes; 4) BPOL; and 5) Meals taxes.

Real estate property taxes accounted for nearly one-half of local revenues, but disparities emerge by form of government. For example, real estate taxes account for 51% of revenues in counties, 45% in cities, but only 22% in towns.

Revenues from personal property, commonly referred to as the car tax, make up nearly 14 cents of every dollar generated by local governments. But the proceeds from the car tax comprise a larger share of local revenues in counties (16%), compared to cities (9%) and towns (5%). The tax generated almost $4.0 billion in FY 2024, second only to real estate taxes in revenue to localities.

Since both of Virginia’s gubernatorial candidates have made public statements recently about eliminating or phasing out the car tax, it’s important for state and local policymakers to remember how revenues in cities, counties, and towns are generated and how local governments allocate those funds. Additional details are likely to follow.

VML Contact: Joe Flores, jflores@vml.org

FOIA

Virginia Freedom of Information Act Advisory Council subcommittees meet

Both the records and meetings subcommittees of the Freedom of Information Act Advisory Council (FOIA) met last week. There was a lot of discussion and agreement to meet again on July 7 for both subcommittees to consider the issues outlined below. The full FOIA Council will also meet on July 7 at 1:00pm with one of the subcommittees meeting prior and one after. The times for those meetings, however, are not yet listed.

The records subcommittee discussed the definition of “personal information” and what the phrase means. The phrase is used in the Government Data Collection and Dissemination Practices Act and sometimes is cross-referenced but there are different ideas on what it means given other parts of FOIA. For example, there was proposed legislation to redact “personal information” for minors who are interning at the state but if they were employed or paid it’s possible that their names would not be redacted. There was no consensus on how to define such, but the subcommittee asked staff to bring more information to the July 7 meeting.

This group also discussed vexatious requests/harassment by requesters which seems to be becoming more of a problem. The FOIA Council studied this issue in 2010 and ultimately could not find a way to separate legitimate requests from these requests. While the committee agreed to keep the issue alive, they did not appear enthusiastic about finding a solution.

The meeting subcommittee took up legislation related to public bodies adding items to their agendas at the last minute. During the most recent General Assembly session, VML worked with other local government lobbyists and the Coalition for Open Government on SB876 which would allow localities to add an agenda item at the last minute if it was “time-sensitive.” However, there were some concerns about Board/Council practices, so the patron agreed to send the bill to the FOIA Council for review. Please review the various versions of the bill (using the link below) and email comments to Michelle Gowdy on whether this language is workable for your locality.

SB876 (Ebbin) Virginia Freedom of Information Act; public bodies to post agenda on website prior to meetings.

VML Contact: Michelle Gowdy, mgowdy@vml.org

Transportation

Commonwealth Transportation Board approves street maintenance reimbursement rate and the Six-Year Financial Plan

The CTB met this week and provided final approval to the Six Year Financial Plan for Virginia’s transportation programs including local maintenance payment rates and the SMART SCALE program. Funding for local maintenance payments increased 3% for FY2026 over FY2025. This results in an increase in urban maintenance payments to $542.5 million for FY2026 from $525.1 million in FY2025. And an increase in maintenance payments to counties to $94.4M for FY2026 from $91.3 million in FY2025.

The approved reimbursement rate for cities and towns for FY2026:

- Principal and Minor Arterials: $30,023/lane mile

- Collector Roads and Local Streets: $17,627/lane Mile

Arlington County’s reimbursement rate is $25,408.56 and Henrico County’s is $18,488.63

The actions taken this week by the CTB are the culmination of the 2-year SMART SCALE road improvement project process and the 6th round of funding. The Six Year Improvement Program is the final step necessary for the approval of Virginia’s transportation budgets and funding process prior to the start of the next fiscal year on July 1.

VML Contact: Mitchell Smiley, msmiley@vml.org

Natural Resources

Virginia Flood Master Plan process underway

The Department of Conservation and Recreation is updating the Virginia Flood Protection Master Plan (VFPMP) with an anticipated release date for the public by December 2025.

VML has been a part of the stakeholder group convened this past winter with the final meeting held this week. Stakeholders include local government organizations including VML, VACo, planning district commissions, nonprofit organizations in addition to state agencies.

The VFPMP is intended to provide state government agencies with a resource that can be used to develop policies and programs to “mitigate the impacts of flooding on people, the economy, and the environment”.

This plan is expected to be implemented by the Department of Conservation under the direction of the Chief Resilience Officer and in coordination with more than a dozen state agencies.

VML has supported increased funding, grants, technical assistance, and support for local governments dealing with the effects of flooding in their community. Members are encouraged to examine the master plan once it is released later this year and provide feedback either to VML directly or to the Department of Conservation and Recreation. Members are also encouraged to submit ideas about how state agencies can better support communities and local governments as they work to mitigate the impacts of flooding.

More information and future updates about the master plan can be found here >.

VML Contact: Mitchell Smiley, msmiley@vml.org

Resources

VDH press release: Virginia sees an increase in drownings in children under five in swimming pools

Health officials urge parents and caregivers to take precautions

RICHMOND, Va. – With great sorrow, the Office of the Chief Medical Examiner has confirmed that six children under the age of five have tragically lost their lives to swimming pool drownings in Virginia since Memorial Day. Swimming season has just started, and these six drowning fatalities exceed Virginia’s total for the number of fatalities for young children for each of the last three years. The Virginia Department of Health urges parents and caregivers to take precautions with children in or near swimming pools or other bodies of water.

“We join with the families and communities grieving the loss of these young lives,” said State Health Commissioner Karen Shelton, MD. “These numbers are heartbreaking. Swimming and playing in pools can be fun, particularly on blistering hot days, but pools can also be dangerous. Families should take caution in and around pools. Children in pools should be supervised at all times, and pools should be gated and secured to prevent access when supervision is not available. Please consider enrolling children in swimming lessons. We want to do everything we can to prevent any more lives lost.”

In the last three years, Virginia had a total of nine pool drownings in children under five years old – three in 2024, two in 2023, and four in 2022. Drowning is the leading cause of death in children between the ages of one and four. But drownings aren’t limited to small children. Between 2020 and 2024, nearly 500 people accidentally drowned in Virginia. Nearly a fifth of them were under the age of 19.

Drownings happen quickly and quietly. Parents and caregivers can take the following precautions to help keep children safe in and around pools:

- Active Supervision: Never leave a child alone near a pool/spa, bathtub, toilet, or standing body of water. When supervising children who are near the water, adults should be free from distractions.

- Swim Lessons: Teach children basic swimming and water safety skills. Swimming lessons can reduce the risk of drowning. Children, even those who’ve had swimming lessons, still need close and constant supervision in or around water.

- Learn CPR: Bystander-initiated CPR can make the difference in someone’s life while waiting for paramedics to arrive.

- Approved Safety Devices: Floaties, water wings, pool noodles and inner tubes are toys. These air-filled or foam toys are not designed to keep swimmers safe. Only use S. Coast Guard-approved life jackets.

- Barriers and Alarms: Install barriers and alarms to prevent children from gaining access to a pool or open water unsupervised.

- Avoid Swimming After Dark: Swimming after dark makes it hard to see if someone is drowning.

- Listen to the Lifeguard: Make sure to listen to any directions from the lifeguard and follow all advisories. But remember a lifeguard does not replace the need for active supervision of any children in and around the water.

Visit swimhealthyva.com for more information. Remember: swim safe, stay safe!

VDH Contact: Brookie Crawford, brookie.crawford@vdh.virginia.gov

Virginia Tech tuition scholarships for recently displaced federal employees

The Virginia Tech School of Public and International Affairs is supporting recently displaced federal employees by offering tuition scholarships for the Graduate Certificate in Local Government Management. A flyer about this opportunity is available here >.

If you have recently hired federal employees and are looking for a great program to help them transition to local government, the VLGMA scholarship can provide additional financial support in conjunction with your tuition assistance programs.

Contact: Stephanie Davis, sddavis@vt.edu | 804-980-5549