eNews – July 18, 2025

VML policy committees begin meeting, Implications of Medicaid cuts to Virginia economy, Supreme Court ruling on nationwide injunctions article...and more!

Friday, July 18, 2025/Categories: eNews

This edition of eNews is sponsored by VACORP providing a comprehensive array of coverages for local governments to make sure you are taken care of, no matter the need. Learn more >

In this issue:

VML News

Finance

Health and Human Services

Resources

Opportunities

VML News

2025 Annual Conference program highlights now available; full  agenda to be posted soon.

agenda to be posted soon.

VML looks forward to welcoming our members to the amazing Hotel Roanoke this October.

The Mayors Institute begins Saturday, October 11 and concludes the morning of Sunday, October 12.

The Annual Conference begins in the afternoon of Sunday, October 12 and concludes mid-morning on Tuesday, October 14.

Program highlights include:

- Awards Reception & Banquet – evening of Oct. 12

- Annual Business Meeting – afternoon of Oct. 13

- Beverages & Bluegrass Reception – evening of Oct. 13

- Closing Session – morning of Oct. 14

Plus, numerous educational sessions and opportunities for networking! A full agenda is in the works and will be made available soon.

Event registration and lodging information are available here >.

See you in Roanoke!

VML Contact: Rob Bullington, rbullington@vml.org

Submit your entries for VML’s 2025 Innovation Awards by Aug. 25

Submit your entries for VML’s 2025 Innovation Awards by Aug. 25

The Virginia Municipal League’s Innovation Awards celebrate the programs and individuals that make it possible for our local governments to solve pressing problems, address emerging needs, and adapt to changing circumstances.

Local governments of all sizes are encouraged to compete for coveted Innovation Awards across seven categories. The entries will be judged based on the scope and results of the project in relation to the community’s size, thereby putting all localities on a level playing field.

One of the seven category winners will be selected for the prestigious President’s Award for Innovation. The winner of the President’s Award will be revealed when all the award winners are honored during the Awards Banquet at the VML Annual Conference in Roanoke in October.

Don’t miss this premiere opportunity to spotlight innovative programs that make your town, city or county a great place for people to call home!

The deadline to submit entries is 5pm on August 25.

Learn more and download the entry form on VML’s website here >.

VML Contact: Manuel Timbreza, mtimbreza@vml.org

VML member organization American Public University launches summer learning opportunities

Plunge into your future…from anywhere! VML member organization American Public University (APU) offers access to an education that’s designed to fit your life…not the other way around.

APU offers:

- Flexible, asynchronous, online classes with monthly starts

- Affordable tuition and a generous 10% tuition grant for Virginia Municipal League members

- Discussion boards, forums, blogs, and other social media that keep you connected

View/Download an informational flyer here >.

Officials and staff from VML member localities can receive a discounted rate by registering here >.

Take the next step — no matter where summer takes you!

APU Contact: Matt Hoffman, mhoffman@apus.edu

Finance

VML’s Finance Policy Committee convenes to discuss current and emerging issues

On Wednesday of this week, VML’s Finance Committee met to receive an update on two significant issues that are likely to be taken up during the 2026 Session of the General Assembly – changes to BPOL and the car tax. In addition, a panel of local officials shared their insights into the development of their recently approved budgets to get a sense of the current economic environment at the local level.

The budget panel included Matt Harris, Deputy County Administrator for Finance and Administration with Chesterfield County, Amanda Six, Director of Finance in the city of Fredericksburg, Keli Reekes, Town Manager for the town of South Hill, and Keith Harless, Town Manager for the town of Pennington Gap.

Most budget officials indicated that they approached their recent budgets with an abundance of caution and are regularly updating their governing bodies to closely monitor revenues and expenditures. Officials in Chesterfield and Fredericksburg have also built flexibility into their budgets to pivot if there are any substantive changes in the coming months.

Interestingly, officials cited lessons learned from the pandemic when they assembled their budgets. To wit, they are not overreacting to the current economic uncertainty but building contingencies into their budgets in case funds become scarce. Federal Medicaid funding changes raised alarm bells in Pennington Gap about the vulnerability of a recently re-opened hospital, but the locality was reassured that the hospital’s operations would not be jeopardized by the enacted changes. Only time will tell if that’s the case. The outlier among localities was the town of South Hill whose coffers are benefiting from business activity related to a large data center. All in all, it was engaging and informative to hear about the diversity of budget approaches taken by localities around the Commonwealth.

The two fiscal policy issues that generated the most discussion during the meeting centered around possible changes to BPOL’s out-of-state deductions for large corporations doing business in the Commonwealth and other states. Expanding the current business deductions may cost localities an estimated $60 million annually and add administrative complexity to the current BPOL tax system.

Proposals emanating from both gubernatorial campaigns to phase out or eliminate the car tax led to a spirited conversation among attendees. Concerns were raised about the negative fiscal impact of eliminating any sources of local revenue at a time when the federal government is resetting its fiscal relationship with state and local governments, tariff policies seem to change by the hour, and the impact of federal layoffs looms with unknown implications for state and local finances. It is an outstanding question whether the candidates plan to replace lost local revenues from the car tax with state general funds or give localities expanded authority to generate local tax revenues to ensure the continuity of local government operations. The answer to that question is critically important for localities.

VML Contact: Joe Flores, jflores@vml.org

“Medicaid cuts will create a macroeconomic shock to Virginia’s economy.”

That was the stunning message delivered earlier this week by Chris Gordon, Chief Financial Officer for the Department of Medical Assistance Services (DMAS) to the Joint Committee on Health and Human Resources (HHR) Oversight.

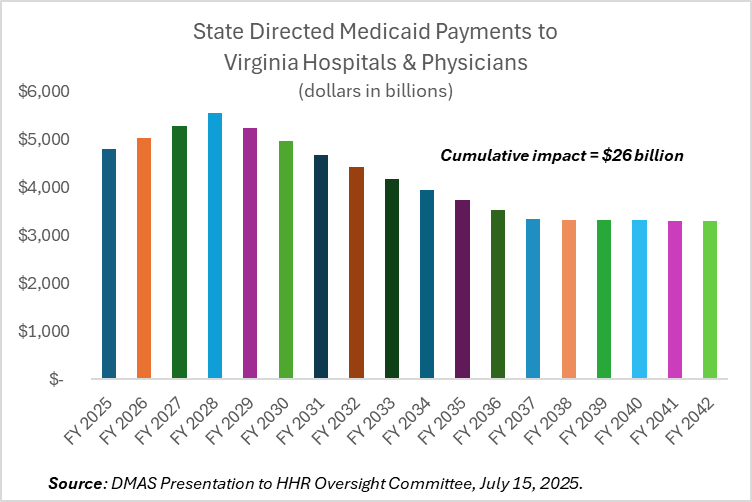

Describing DMAS’ initial fiscal analysis of provisions contained in the recently passed federal budget, Mr. Gordon indicated that Medicaid revenues will begin to decline beginning October 1, 2028, resulting in cumulative reduction in funding to hospitals and physicians in the Commonwealth of $26 billion (see graph below).

Hospitals are major economic engines in many communities, directly employing more than 140,000 people in fiscal year 2023 and supporting an additional 320,000 indirect positions, according to data included in the Virginia Hospital and Healthcare Association’s FY 2025 Annual Community Benefit Report. Rural hospitals are particularly vulnerable to changes in Medicaid funding, which explains, in part, why Congress established a Rural Health Transformation Program to shore up the finances of rural hospitals in the short run. These time-limited funds may be available as soon as January 1, 2026, depending upon guidance to be issued by the Centers for Medicaid and Medicare Services (CMS) and are expected to provide $100 million annually for five years to rural hospitals in Virginia.

It is worth noting that the Medicaid reductions referenced above are not slated to take effect until October 1, 2028, or fiscal year 2029, so hospitals will have time to explain the impact of these funding changes on patient care in the communities where they operate. Whether that changes the minds of lawmakers in the days to come is an open question.

VML Contact: Joe Flores, jflores@vml.org

Health and Human Services

CSA census and costs rise, led by private special education placements

After experiencing a dip in census during the COVID pandemic that continued through fiscal year 2022, the number of children served by the Children’s Services Act (CSA) has rebounded and now slightly surpassed the pre-pandemic level as of fiscal year 2024. Expenditures for the program remained fairly flat during fiscal years 2021 and 2022 as well, but began to grow again in fiscal 2023 as well. These figures were presented by Office of Children’s Services Director Scott Reiner to the General Assembly’s Joint Subcommittee for Health and Human Resources Oversight on July 15 in Richmond.

Reiner said that for fiscal years 2024 and 2025, CSA expenditures grew about 13 percent each year. The largest area of growth is overwhelmingly in the private day special education program. The annual cost per student in this program grew from $46,006 in fiscal year 2020 to $55,509 in fiscal year 2024. Thirty percent of the CSA mandated population is served in private day special education and special education wraparound services but account for 45 percent of total CSA program expenditures. In contrast, 66 percent of the youth served in CSA receive community-based services (e.g., intensive in-home/mentoring/behavioral therapies/parent coaching/assessments), but these services account for only 12 percent of total CSA program costs.

Who is served in special education private day programs? Youth with Individualized Education Plans (IEPs) from their public school whose educational/behavioral needs outstrips the ability of a local school division to adequately serve them in their community school. The typical diagnosis is autism.

Who is eligible for CSA? CSA serves children who receive foster care services (including foster care prevention and non-custodial agreements and those in custody of the local department of social services); students with educational disabilities in private special education programs per their IEP; Children in Need of Services (CHINS), and children with significant behavioral/emotional needs involved with more than one state or local agency. Most children in the program are eligible for sum-sufficient services.

Who administers the CSA? Local governments administer the CSA program on behalf of the state and share in the costs of the program. The average locality match is 35 percent, but ranges from about 19 percent (Northampton County) to more than 53 percent (City of Alexandria) depending on the fiscal strength of the locality. Different types of services also have different match rates, with community-based services having the lowest local match requirement.

VML Contact: Janet Areson, jareson@vml.org

Yet another workgroup is looking at local and regional juvenile detention

Closing or consolidating local and regional juvenile detention facilities is once again the subject of a workgroup, this time convened by a single legislator who really wants to see consolidation and closure happen.

Senator David Marsden, who previously led a study of facility closure/consolidation by the General Assembly’s Youth Commission and then obtained budget language directing a workgroup led by the Virginia Department of Juvenile Justice, is leading a workgroup this summer to press the case for closures/consolidations of facilities primarily in Northern Virginia, Central Virginia (i.e., Richmond area), and Hampton Roads.

Marsden patroned legislation in the 2025 General Assembly session to direct closures/consolidations of facilities in those areas (SB 1432). His bill was turned down in a Senate committee on a bipartisan vote.

Marsden’s hand-picked workgroup this summer includes members of the House and Senate, including Delegates Jed Arnold, Terry Austin, Cliff Hayes, Mike Jones, Mark Sickles, and Senators Jennifer Boysko, Barbara Favola, Chris Head, Christie New Craig and Angela Williams-Graves. Also on the group are representatives of VML and VACo, the Virginia Department of Juvenile Justice and Department of Education, former DJJ director Andy Block, the Department of Planning and Budget, and the Commonwealth Institute for Fiscal Analysis.

The group met June 30 in Fairfax and will meet again later this summer/fall in the Richmond and Hampton Roads areas.

VML Contact: Janet Areson, jareson@vml.org

Federal budget impacts, CSA on agenda for VML’s HD&E Policy Committee

An overview of some of the potential impacts from HR 1 (federal reconciliation bill) as well as detailed potential impacts on local social services were among the topics of discussion at the VML Human Development and Education Policy Committee (HD&E) meeting on July 17. Also discussed was the issue of the state cap on reimbursements to private special education day placements under the Children’s Services Act (CSA) that was included in the General Assembly passed budget this year.

Senate Finance and Appropriations Senior Analyst Mike Tweedy presented information to the committee on HR 1. He focused on provisions in the bill affecting the funding and administration of the Supplemental Nutrition Assistance Program (SNAP) and Medicaid. Until the passage of this bill, states and localities administered SNAP on behalf of the federal government but did not pay a share of costs for either administration or benefits in the program. HR 1 will impose a state match requirement for SNAP benefits of up to 15 percent based on the state’s payment error rate, effective Oct. 1, 2027. This could cost Virginia between $90 - $270 million a year and will increase pressure on local social services offices to reduce error rates, which are determined by very small samples of a locality’s caseload. According to another speaker at the meeting, Middlesex Social Services Director Rebecca Morgan, only five states meet the bill’s required limit of a six percent error rate to avoid the new state match requirement.

Tweedy also told the Committee that administrative cost sharing between the state and federal government would increase from 50 percent to 75 percent effective Oct. 1, 2026. This would cost Virginia between $80-$90 million a year and would also affect the local match share with the state. Other components of the bill would increase complexity to the eligibility determination and redetermination processes and other caseload work carried out by local social services offices.

On the Medicaid front, local social services will be affected by the administrative burdens created by new Medicaid recipient work requirements under the bill. These will take effect in late 2026. Increased eligibility determination/redetermination requirements will also affect local social services offices because recipients will have to go through redetermination every six months as opposed to once a year. There are also new penalties for certain erroneous excess payments under Medicaid that will be effective Oct. 1, 2029. Information on the details of that component of the bill is not yet available.

Rebecca Morgan gave the Committee a more detailed view of how HR 1 and other federal funding changes are affecting local social services operations. She remarked on the need for Virginia to update its caseload management information system to better help local case managers and eligibility workers better document and follow through with service recipients.

Goochland County CSA Coordinator Mills Jones explained the changes in the state budget affecting the state match for private special education day placements under the Children’s Services Act (CSA) program. For the first time in the history of the CSA program, the state capped its reimbursement for a sum-sufficient service. Specifically, the language says that if a private special education placement increases in cost by more than five percent from the previous year, the state will cap its reimbursement at the five percent level. It’s worth noting that the increase in these placements has been averaging more than 10 percent a year.

The Committee revised its policy statement and agreed on topics to send to the VML Legislative Committee for further consideration, including the issues of support for public education, ending the state reimbursement cap for CSA, and supporting local authority over local and juvenile detention facilities.

VML Contact: Janet Areson, jareson@vml.org

Resources

NLC article explains implications of Supreme Court ruling affecting nationwide injunctions

The article below was originally published on the National League of Cities’ blog and is shared here with permission. The article was co-authored by Amanda Karras, the Executive Director and General Counsel for the International Municipal Lawyers Association (IMLA). NLC, IMLA, and NACo formed the Local Government Legal Center (LGLC) in 2023, a coalition of national local government organizations to provide education to local governments regarding the Supreme Court.

Related information: On July 28th NLC will host a webinar (register here) along with its Local Government Legal Center partners, regarding the major cases of the SCOTUS term impacting local governments. A recording of the webinar will be available after the event.

Supreme Court Rules on Nationwide Injunctions

While the origins of injunctions date back to the early 1900s, their use has not been historically common, at least until the last few decades. According to the U.S. Department of Justice (DOJ), federal courts issued 12 nationwide injunctions during the George W. Bush Administration, 19 during the Obama Administration, 55 during the first Trump Administration (through February 2020), 14 during the Biden Administration and 25 during the first 100 days of the second Trump Administration.

Given this recent trend, local leaders have looked to the courts to provide guidance on the implementation of administrative actions and their impact on municipal operations. In June, both the Supreme Court and the District Court of Rhode Island issued decisions in cases that provide greater clarity into how injunctions will apply to local governments moving forward.

Trump v. Casa

As the Supreme Court finished up their term, they issued the decision in Trump v. Casa (PDF), the birthright citizenship case. The merits of the birthright citizenship Executive Order was not at issue in this case. Instead, it was about whether courts can issue universal or nationwide injunctions. The Court held in a 6-3 decision authored by Justice Barrett that universal injunctions that grant relief beyond the relief necessary to the parties to the suit likely exceed the authority of district courts and cannot be issued.

On President Trump’s first day in office, he signed Executive Order No. 14160 entitled Protecting the Meaning and Value of American Citizenship (PDF) (“EO”), which identified circumstances in which persons born in the United States would not be considered citizens. Several lawsuits quickly mounted, including suits filed by individuals, organizations and states, which sought to enjoin the enforcement of the EO. In each case, the district court concluded that the EO was likely unlawful and entered a universal preliminary injunction, prohibiting the administration from enforcing the EO as to anyone in the country. The federal government sought a stay of those universal injunctions pending litigation, and each federal appellate court denied the stay. The federal government then filed emergency applications for a stay of those universal injunctions with the Supreme Court. The federal government did not ask the Supreme Court to reach the merits of the Executive Order.

The Court held that universal injunctions exceed the authority of federal courts under the Judiciary Act of 1789. The Judiciary Act of 1789 confers federal courts with jurisdiction over “all suits … in equity,” and while equitable authority is “flexible,” it is not “freewheeling.”

To determine if a universal injunction is an available type of equitable relief, the Court asks whether it is the type of remedy “‘traditionally accorded by courts of equity’ at our country’s inception.” The question is therefore “whether universal injunctions are sufficiently ‘analogous’ to the relief issued ‘by the High Court of Chancery in England at the time of the adoption of the Constitution and the enactment of the original Judiciary Act.’” Per the Court, “the answer is no: Neither the universal injunction nor any analogous form of relief was available in the High Court of Chancery in England at the time of the founding.” The Court explained that there was “no remedy ‘remotely like a national injunction’” at that time, rejecting the Respondents’ and dissents arguments that a bill of peace was an analogous form of equitable relief at the time of founding. Moreover, the Court noted that the practice of universal injunctions did not emerge until the mid-twentieth century, providing further evidence of the lack of historical foundation.

Lower Court Implications

This case is important for local governments as universal injunctions have been used in the past in litigation involving challenges to changes to federal grant conditions. For example, during the first Trump administration, several district courts issued nationwide injunctions prohibiting the DOJ from imposing immigration conditions on the Edward Byrne Memorial Justice Assistance Grant, the primary source of federal funding to support justice programs for state and local governments.

More recently, lower courts have been imposing universal injunctions with less frequency in cases involving local governments. For example, in California v. U.S. Department of Transportation (USDOT), like many of the current legal challenges before the lower courts regarding the termination of grants or conditions on grants, the plaintiffs, a coalition of 20 attorneys general, did not seek a universal injunction. The case involves a challenge to USDOT’s imposition of immigration enforcement conditions on recipients of transportation grants. The preliminary injunction in this case applies only to the 20 states included in the suit and the local governments within these states. This approach is likely because courts and litigants were aware the Supreme Court would be weighing in on the issue, and many Justices had previously expressed skepticism over their practice.

Legal Strategies Moving Forward

Moving forward from the Court’s ruling, any cases that do involve universal injunctions would likely need to be modified. For local governments seeking to find relief from administrative actions that are not already involved in litigation, they will need to consult with their general counsel to determine whether engaging in litigation on behalf of their municipality and/or in coordination with their state or other local governments is appropriate. Additionally, class action lawsuits may be another avenue for parties seeking broader relief.

NLC Contact: Andrea Fox, Mail@ConnectedCommunity.org

Opportunities

Call for entries: VDOT's inaugural locality awards competition

VDOT's Local Assistance Division is thrilled to announce its first Virginia Locally Administered Projects (LAP) Awards Competition, celebrating the outstanding achievements and innovative projects undertaken by our local partners. This is your chance to showcase your hard work and be recognized for your dedication to improving transportation in your communities. Local governments of all sizes are encouraged to compete for coveted LAP Awards across seven categories. The entries will be judged based on the scope and results of the project in relation to the community’s size, thereby putting all localities on a level playing field.

Entries are due August 1, 2025

Learn more about how to apply here >

Award Categories:

- Excellence in Regional Transportation

- Community Impact

- Safe and Accessible Streets

- Active Transportation | Bicycle and Pedestrian

- Environmental Excellence | Stewardship

- Operations and Maintenance Excellence

- Project Management Excellence

Winners will be announced at the VDOT Local Programs Workshop during the Opening Plenary on September 16, 2025.

VML Contact: Mitchell Smiley, msmiley@vml.org

Prince George County announces EDA Micro-Business Grant Program

Prince George County’s Economic Development Authority has launched a Micro-Business Grant Program. Applications close August 31, 2025 with funding to be awarded in September. This grant promises to be an incredible resource for small business owners in the county.

More information is available here >.

Prince George County Contact: Hannah Thomas, hthomas@princegeorgecounty.gov